capital gains tax rate canada

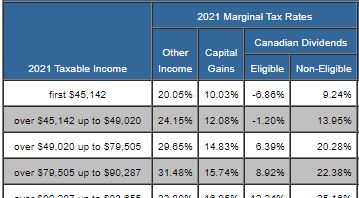

It is included in your annual taxable income and taxed at your marginal tax rate. 5 Ways to Connect Wireless Headphones to TV.

Capital Gains Tax The Blog By Javier

The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

. Only 50 of the capital gains of stocks are taxable at the. Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt. When calculating the capital gain or loss on the sale of capital property that was made in a foreign currency.

In Canada capital gains are taxed at 50 of your marginal rate. Capital Gains Tax Rate. 5 Ways to Connect Wireless Headphones to TV.

Deferral election is not taken but can claim CCA. When you sold the 100 shares this year you received 50 per share and paid a 50 commission. In Canada 50 of the value of any capital gains are taxable.

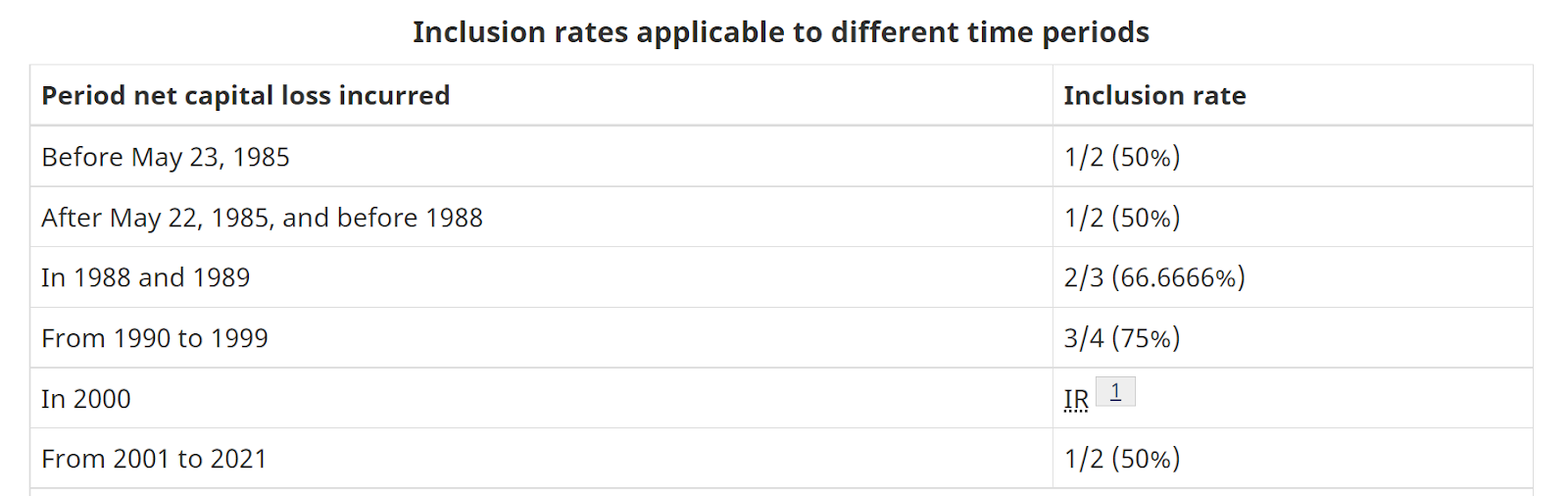

Should you sell the investments at a higher price than you paid realized capital gain youll need to. The inclusion rate for. 2023 capital gains tax rates.

The capital gains tax is the same for everyone in Canada currently 50. Capital gains taxes on assets. For a Canadian who falls in a 33.

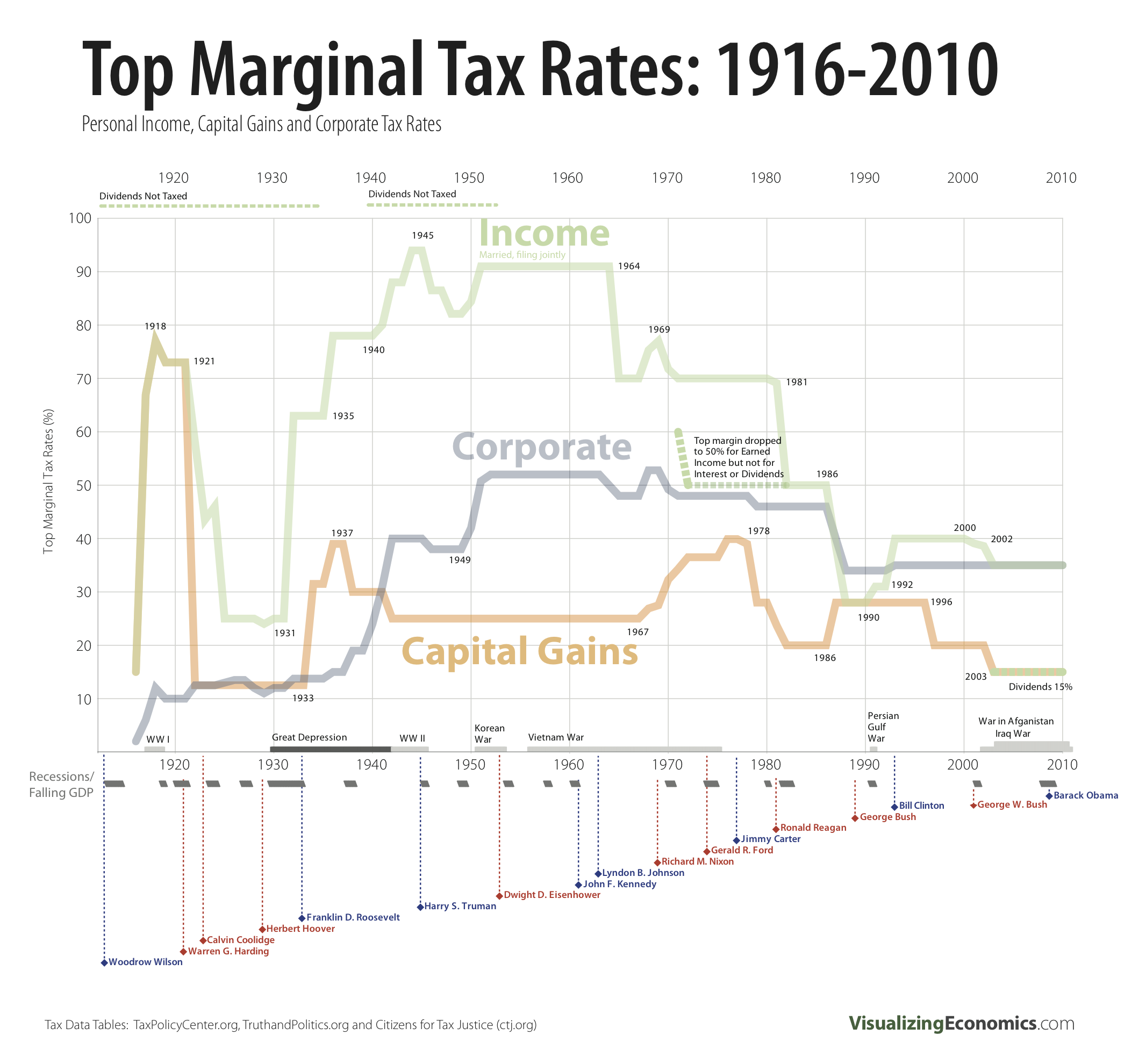

So for example if you buy a stock at 100 and it earns 50 in value when you sell it the total. In Canada half of the worth of any gains is taxable. A Capital Gains tax was first introduced in Canada by Pierre Trudeau and his finance minister Edgar Benson in the 1971 Canadian federal budget.

Convert the proceeds of disposition to Canadian dollars using the Exchange. Again in Canada capital gains get a better tax treatment and are taxed at a lower rate than both dividends and interest. And the tax rate depends on your income.

At the end of the day on the off chance that you sell a venture at a greater cost than you paid. The inclusion rate has varied over time see graph below. In Canada only 50 of the total capital gains is taxable.

The total amount you received when you sold the shares was 5000. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. Surface Studio vs iMac Which Should You Pick.

Surface Studio vs iMac Which Should You Pick. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. As of 2022 it stands at 50.

Capital gains tax in Canada. Capital Gains Corporate Tax Rate Canada. 2022 capital gains tax calculator.

The inclusion rate is the percentage of your gains that are subject to tax. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Capital Gains Tax Rates for Fiscal.

Lets say you sold BMO which I would never do its one of my favourite Canadian dividend stocks for a. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than.

A capital gain refers to any profit made by selling capital or passive assets including businesses stocks shares goodwill and land. Capital gains only apply when.

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates

Short Term And Long Term Capital Gains Tax Rates By Income

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Opinion Biden S Capital Gains Tax Hike Is His Fourth Hit On The Rich Marketwatch

U S Estate Tax For Canadians Manulife Investment Management

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

These Are The Obama Tax Hikes That Will Really Hurt American Enterprise Institute Aei

What Is The Difference Between The Statutory And Effective Tax Rate

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Northern Trust Wealth Management Asset Management Asset Servicing

Fluctuations In Top Tax Rates 1910 To Today Sociological Images

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

Capital Gains 101 How To Calculate Transactions In Foreign Currency

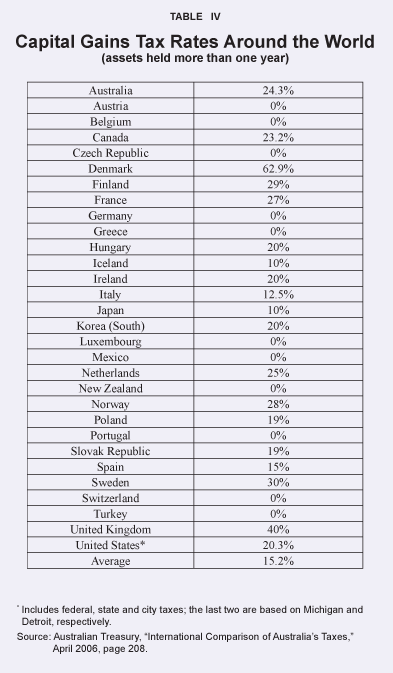

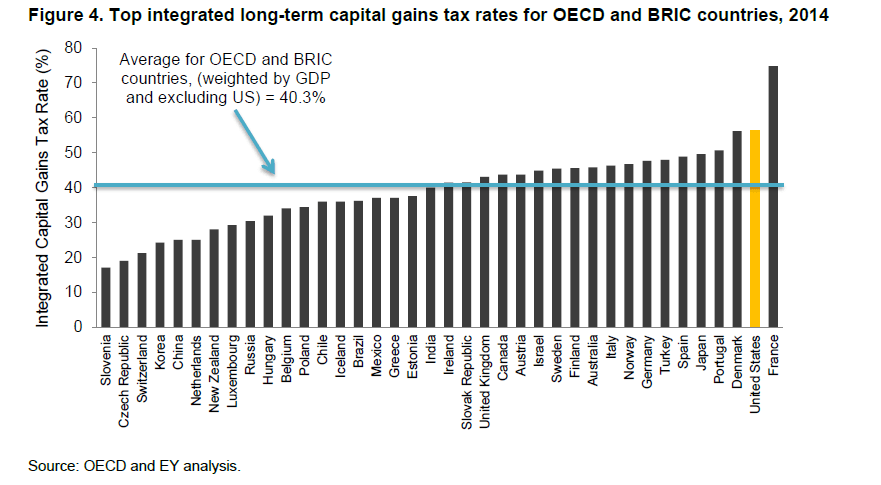

International Top Long Term Capital Gain Tax Rates Comparison Where Does The Us Stand Topforeignstocks Com

Capital Gains Tax Rate Rules In Canada What You Need To Know