omaha nebraska vehicle sales tax

Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832. 49 rows Amended Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Note.

Gregg Young Chevy Omaha Nebraska Ne Car Dealership Dealer License Plate Tag Name Ebay

Vehicle Title Registration.

. The Nebraska state sales and use tax rate is 55 055. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. Sales and Use Tax Regulation 1-02202 through 1-02204.

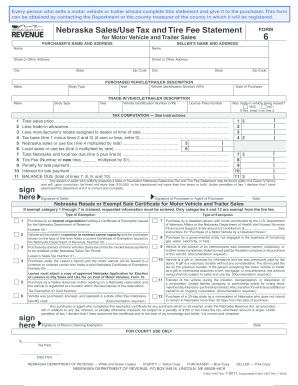

Department of Revenue Current Local Sales and Use Tax. Nebraska vehicle title and registration resources. The Seller must also provide the buyer with a Bill of Sale or a completed Nebraska Department of Revenue Form 6 Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle And.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. The Nebraska state sales and use tax rate is 55. Greater Omaha Chamber of Commerce UNO.

Repair labor on motor vehicles. Registration Fees and Taxes. The December 2020 total local sales tax rate was also.

315806 State Sales Tax 184718 Motor Vehicle Tax 700 Local. Get rates tables What is the sales tax rate in Omaha Nebraska. This is the total of state county and city sales tax rates.

Purchase of a 30-day plate by a. Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660 Total. Omaha NE Sales Tax Rate Omaha NE Sales Tax Rate The current total local sales tax rate in Omaha NE is 7000.

The County Treasurer will calculate the amount of the unused motor vehicle tax motor vehicle fee and registration fee complete and authorize their portion of the application form and. At 800-742-7474 NE IA or 402-471-5729. Repair labor performed on any item the sale of which is not subject to sales tax.

What is Nebraska state sales tax rate. Contact Nebraska Taxpayer Assistance. County or City 2021 Net Taxable Sales 2020 Net Taxable Sales Percent Change 2021 Sales Tax 55 2020 Sales Tax 55 Adams 9019340 8420096 71 49770185.

There are no changes to local sales and use tax rates that are effective January. Repair labor involved in restoring the original. Driver and Vehicle Records.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023. This form is read only meaning you cannot print or file it.

Making Cents Why Nebraska Should Modernize The Sales Tax Pt 1

Previously Owned Cars Auto Repair Service Prime Auto Omaha

![]()

All Bmw Inventory 2021 2022 Bmw Models For Sale Omaha Nebraska And Western Iowa Bmw Motorcycles Of Omaha

Nebraska Title Transfer Etags Vehicle Registration Title Services Driven By Technology

131 Branded Title Cars For Sale In Omaha Nebraska Autosavvy

Used Cars Trucks Suvs For Sale In Omaha Ne L Near Lincoln

Buy A Used Car Near Omaha Ne Pre Owned Vehicles For Sale

Used Cars For Sale In Nebraska Edmunds

Vehicle And Boat Registration Renewal Nebraska Dmv

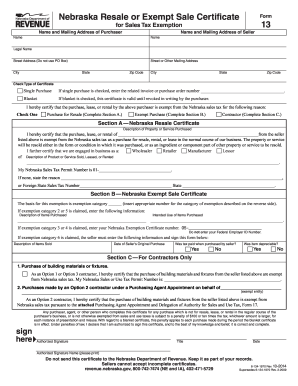

Form 13 Nebraska Fill Out And Sign Printable Pdf Template Signnow

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Previously Owned Cars Auto Repair Service Prime Auto Omaha

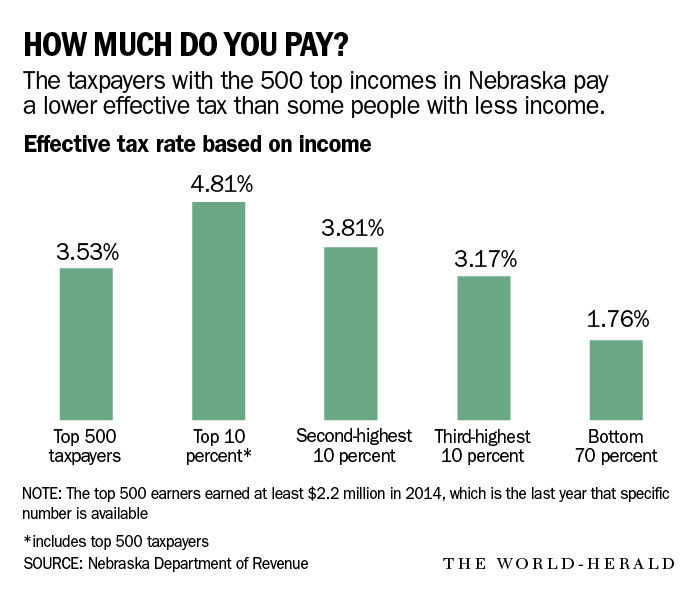

Hansen Want Lower Nebraska Property Taxes We Need To Have A Chat About Income Taxes Archives Omaha Com

29 000 For An Average Used Car Would Be Buyers Are Aghast Abc News

New Ford F 150 For Sale In Omaha Nebraska F 150 Near Me

New 2022 Polaris Ranger 1000 Utility Vehicles In Omaha Ne Stock Number

Nebraska Sales Tax Calculator Reverse Sales Dremployee

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow